|

A proven state-of-the-art system to help participants make the right PRT lump sum elections…and get a picture of their retirement few would otherwise ever receive...

Lump sum elections as a result of de-risking activity from defined benefit pension plans are key to the process.

“…three out of four boomers don’t have a written financial plan for retirement. For millennials, 87 percent don’t have a plan and 81 percent of Gen Xers are without a plan.” – Fidelity

For more information contact us.

The SystemLSA is the proven state of the art system years in the making with updated capabilities for the 2020’s.

Tens of millions don’t have much insight into their retirement.

Americans are under-achieving when it comes to retirement. The reasons are about evenly divided among "never thought about", "wouldn't know where to start", and some version of "I already know I'm screwed".

The LSA provides a retirement analysis for users who are at a critical juncture in their retirement planning: Do I take the lump sum or keep my pension, albeit in the form of an annuity? Participants who deserve – though rarely get – written analyses can get one in minutes.

Participant advantages include:

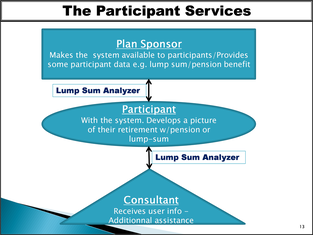

Participant Services with the LSAOur services, systems, and consultants can help participants and plan sponsors alike. Aimed at improving the Participant’s Experience, PS is a combination of services for participants, with the plan sponsor’s support and involvement.

Events The process begins with information. Participants are offered access to lump sum election education forums/meetings. These sessions are free and made available at convenient locations and times. They allow members to ask questions about their options and get as much information as they need/want to make their decision. Additionally, interactive webinars are made available. Systems – Lump Sum Analyzer (LSA) Our online systems help users decide which option is best for them and their retirement, independent of any product, carrier, investment company, etc. Customized for each plan sponsor, the Lump Sum Analyzer combines plan level data with the user’s confidentially provided retirement assumptions, so users can see the impact of their choices. Participant Consultants The personal, human touch. Working with specially trained advisers all participants can access unbiased advice regarding their election and retirement planning during the election period. Consultations are available online, over the phone, and in person where practicable. Benefits to Plan Sponsors

Benefits to Participants

|

To learn more about how we help participants and sponsors with their lump sum election decisions and process download our Participant Services pdf by clicking here.

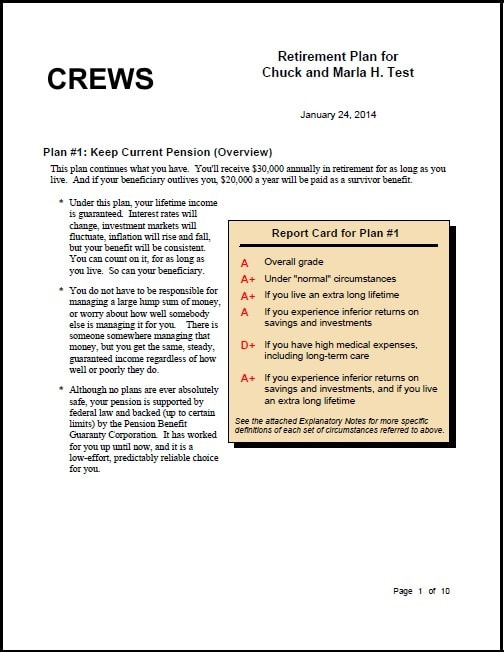

Lump Sum Analyzer DemoWould you like help deciding? By spending a bit of time with our Lump Sum Analyzer (LSA) system participants can see the impact of the pension vs. lump sum choice using their own personal financial and other information. The following is for demonstration purposes only and results should not be relied upon until actual actuarial data is linked to the system separately. Contact us for a more robust walk through. Sample Report

For more information contact us.

|

Home Plan De-Risking Participant Services Sample Co. Lump Sum Elections Guarantees CES-CREWS Blog About Contact

© 2016–2024 Corporate Executive Strategies. All rights reserved.

© 2016–2024 Corporate Executive Strategies. All rights reserved.