|

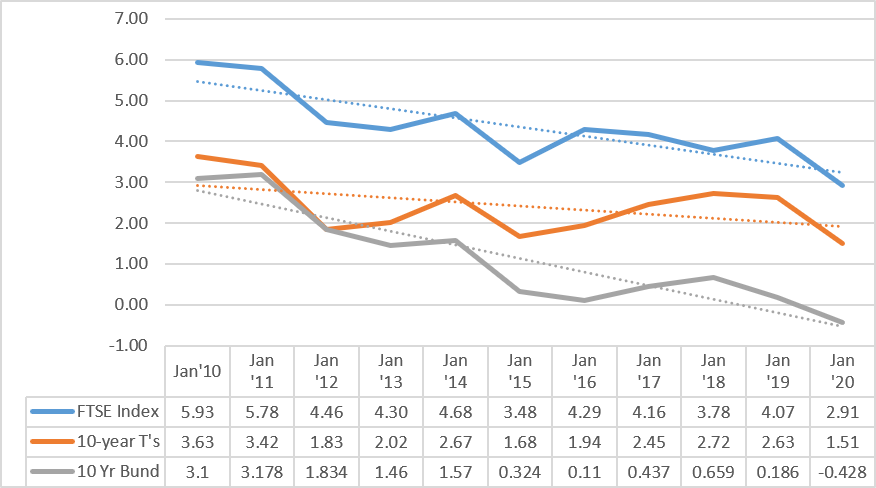

By Steve Richards With the 10-year Treasury yield hitting an all time low on Tuesday it seems a good time to reflect on the impact of such low yields on DB plan de-risking and terminations. The efficacy and timing of de-risking moves basically comes down to where one thinks interest rates are going. The conventional wisdom for years now is that rates are heading up, and most think that pulling the trigger on buying annuities and/or offering lump sums is just not a good idea. Why? Because as rates go up the price of Single Premium Group Annuities (SPGAs) go down. Likewise, the cost of lump sums. Obviously, this conventional wisdom has largely proved wrong. What’s worse is that these could be the good old days when plan sponsors will look back and say to themselves: “Boy, I sure wish we had made those de-risking moves way back when…” Especially if equity markets tank, always a risk. 10-Yr Treasuries vs FTSE Pension Liability Index vs 10-Yr Bund Since 2010

0 Comments

|

Home Plan De-Risking Participant Services Sample Co. Lump Sum Elections Guarantees CES-CREWS Blog About Contact

© 2016–2024 Corporate Executive Strategies. All rights reserved.

© 2016–2024 Corporate Executive Strategies. All rights reserved.

RSS Feed

RSS Feed