|

The lawsuit involves a Florida based hospital provider that hired Aon to terminate its $100+ million DB plan which included lump sum election services. Things went awry when the take-up rate for the lump sum choice came up less than Aon had advertised… By Steve Richards The Aon PRT case is more than a little complicated. Therefore, we need to peel back the onion a layer or two. The lawyers added many layers, but the magistrate pierces them all and exposes fiduciary risks. The decision’s name gives an inkling of just how many layers there were to peel back:

The decision by a magistrate judge out of the U.S. District Court for the Middle District of Florida was meant to clear up a murky set of esoteric regs from various sides of the PRT mountain of rules and conventions such that no one (even the judge that called for the analysis) could make decisions about the particulars of the case. The analysis was needed by the court to get to the bottom of things. The decision recommended the rejection of the dismissal of the lawsuit called for by Aon and Alight. Here’s how Plan Sponsor’s John Manganaro put it in his article about the decision. (Magistrate Judge Says Aon, Alight Can’t Evade PRT Lawsuit | PLANSPONSOR) Technically, the report recommends four things. First, it suggests that Aon Hewitt Investment Consulting’s motions to exclude the expert reports and testimony of two of the plaintiffs’ lead witnesses should be denied. Second, it recommends that the plaintiffs’ motion for partial summary judgment declaring that Aon Hewitt Investment Consulting is a fiduciary to the plan in question should be granted. Next, it denies the Aon defendants’ dismissal motion, and, finally, it denies a related dismissal motion filed by Alight…The report then details what plaintiffs in the case say are Aon’s failures to live up to its contractual agreements.

Lump sum election communications often get short shrift in PRT cases. But there are many reasons why this is a risky approach, and we have addressed some of those in the past. Now, in addition, it seems clear that things like lump sum election communications and take-up rates now carry the specter of potential lawsuits and carry a previously underappreciated impact on fiduciary exposure.

0 Comments

The lawsuit involves a Florida based hospital provider that hired Aon to terminate its $100+ million DB plan which included lump sum election services. Things went awry when the take-up rate for the lump sum choice came up less than Aon had advertised… Magistrate Judge Says Aon, Alight Can’t Evade PRT Lawsuit | PLANSPONSOR

First, it's important to note that a decision went in Aon’s favor since this suit was filed and the article written. Aon, Alight Win Judgment in Hospital PRT Lawsuit | PLANSPONSOR In the actual complaint in the case the court just addressed preliminary motions. However, it is clearly critical of Aon/Hewitt, and is sympathetic with the plaintiff. and justifies its arguments with precedent, logic, and evidence. The breach in promise regarding participant services is not the central element in the case. It is part of a larger and more directly illegal problem: did Aon/Hewitt breach its fiduciary duty with regard to investment strategy and timing? The evidence indicates that they did, and this was mostly in ways unrelated to the failure to provide participant services. And to the extent the participant services are part of the problem, the complaint is not DIRECTLY that they failed to provide them (and therefore injured the interests of the participants) but that they did not persuade enough participants to take the lump sum option, which hurt the financials of the transaction and resulted in additional losses to the plan sponsor. “Leading up to the lump sum election window, Hewitt did not perform all the communications services that it contracted to perform under Schedule 5 of the [contract], including announcements, in-person meetings, webinars, brochures, posters, banners and other print materials,” the report states, citing the plaintiffs’ allegations. “Ultimately, only 67% of eligible plan participants elected to take a lump sum, instead of the projected 80%. … To complete plan termination, the plan’s invested assets were liquidated in two parts, first to pay lump sum benefits, and then to buy annuities. Plaintiffs claim that despite FRC’s requests, Aon Hewitt Investment Consulting refused to liquidate the plan funds for weeks leading up to December 2016.” It also looks like they do not take participant services very seriously. They promise, then back out of delivering. At least in this one situation -- but I see nothing in this situation that needed to interfere with their delivery of those services, and I didn't notice any sign of internal push-back within Aon about not fulfilling their promises. How will Aon/Hewitt and other firms handle participant services going forward? They could conclude that they need to do a much better job of it and then follow through on that. Or they could go the other way and see the offer of participant services as a potential liability for them, and so they could scale back offering these services. It's also important to note the motivation for providing these services -- i.e., to maximize the percentage who take the lump sum offer. They do this because it's cheaper and less financially risky for the plan sponsor to pay out lump sums than it is to buy annuities. But this means that they interpret their own fiduciary responsibility as aimed particularly at the plan sponsor, and do not feel the same fiduciary responsibility to the plan participant. But the fiduciary role arises from ERISA, and the purpose of ERISA is to protect the interests of participants, and famously puts a lot of extra burdens on the plan sponsor that cost them money, so the law is on the participants' side much more than on the plan sponsors' side. And therefore taking the side of the sponsors (by actively promoting lump sums instead of offering neutral or participant-centric advice) itself is arguably a breach pf fiduciary duty -- though the court didn't address this and almost certainly won't. Furthermore, as the court in this case does say, AON/Hewitt probably had a fiduciary duty even if they had not explicitly said in advance they were acting as a fiduciary. One could argue, therefore, that the Aon/Hewitt approach, which appears motivated by their own self-interest in making the plan sponsor happy, is actually (or at the very least potentially) illegal. The key takeaway seems to be: Do you want to work with a firm whose mission is to help participants make the best decisions for THEM -- keeping in mind that you [the decision-makers] along with your colleagues and people who have worked for you for many years are the beneficiaries here -- or will you trust the quantity and quality of help you will get from one of the giant firms whose main interests and motivations lie elsewhere?"

*|MC_PREVIEW_TEXT|*

Part of a continuing series. You have several main options, though some of them come in multiple flavors: Option #1 of 4 – Keep the Pension This option applies only if the lump sum offer is coming from a traditional pension plan that provides a guaranteed retirement income for life. It does not apply to most 401(k) plans, or other similar plans where you have a specific account balance. Advantages:

Disadvantages:

Up next: Option #2 - Take the lump sum and roll it over into a tax- advantaged retirement plan  For more about CESCrews' Participant Services for Lump Sum and Pension Elections click here. Part of a continuing series. You’ve been told you have the option of converting all or part of your pension plan to an immediate cash payment (a “lump sum”). What should you do? Fifteen things to think about…

You’ve been told you have the option of converting all or part of your pension plan to an immediate cash payment (a “lump sum”). What should you do? Just as important, how do you even think about this in a sensible way?  For your free copy just click on the pamphlet cover above. For your free copy just click on the pamphlet cover above. First, let’s distinguish three circumstances under which you might have the option of taking a lump sum from your pension plan:

Although each of these situations is different, most of the thought process you should go through is the same. Even so, there is more than one way to think about this decision.

Of course, if the lump sum amount is small, none of this matters a great deal. But if it represents more than a few paychecks to you, then it’s worth putting some serious thought into. And that’s what our guide "Should You Accept A Lump Sum From Your Pension Plan?" is for. For a free copy click here.  An updated, proven system to help participants make the right PRT lump sum elections…and get a picture of their retirement few would otherwise ever receive. Tens of millions don’t have much insight into their retirement.

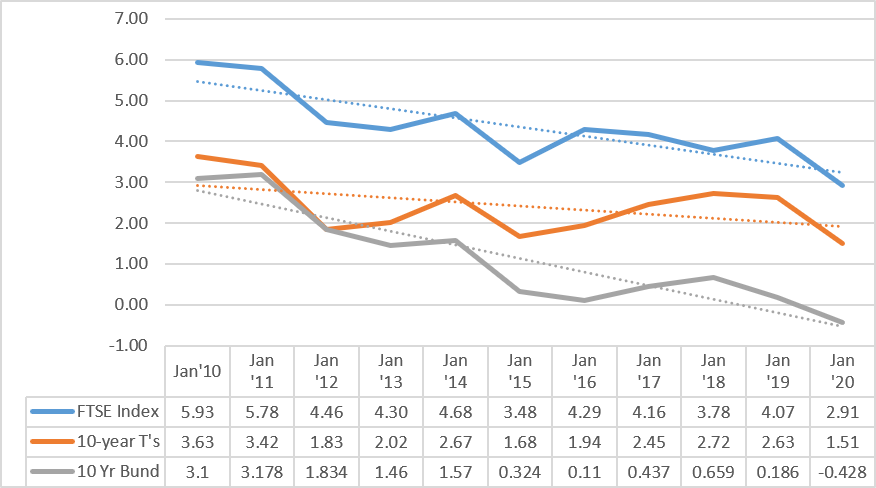

The LSA provides a retirement analysis for users who are at a critical juncture in their retirement planning: Do I take the lump sum or keep my pension, albeit in the form of an annuity? Participants who deserve – though rarely get – written analyses can get one in minutes. By Steve Richards With the 10-year Treasury yield hitting an all time low on Tuesday it seems a good time to reflect on the impact of such low yields on DB plan de-risking and terminations. The efficacy and timing of de-risking moves basically comes down to where one thinks interest rates are going. The conventional wisdom for years now is that rates are heading up, and most think that pulling the trigger on buying annuities and/or offering lump sums is just not a good idea. Why? Because as rates go up the price of Single Premium Group Annuities (SPGAs) go down. Likewise, the cost of lump sums. Obviously, this conventional wisdom has largely proved wrong. What’s worse is that these could be the good old days when plan sponsors will look back and say to themselves: “Boy, I sure wish we had made those de-risking moves way back when…” Especially if equity markets tank, always a risk. 10-Yr Treasuries vs FTSE Pension Liability Index vs 10-Yr Bund Since 2010By Steve Richards

I remember it like yesterday when we incorporated the predecessor of CES-Crews in 1999. Ah, the good old days:

Welcome to ,CES-CREWS' new blog on the fascinating world of DB plan de-risking and termination trends.

Just who needs that you might be saying? Well, our blog is uncommonly interested in a point-of-view which is often lacking in this area: the participants. Not that we aren’t interested in the plan sponsor – quite the opposite. But plan sponsors generally have a phalanx of advisers available to them and no shortage of analyses to read about themselves. Participants? Not so much. |

Home Plan De-Risking Participant Services Sample Co. Lump Sum Elections Guarantees CES-CREWS Blog About Contact

© 2016–2024 Corporate Executive Strategies. All rights reserved.

© 2016–2024 Corporate Executive Strategies. All rights reserved.

RSS Feed

RSS Feed